Market Monitor | Mid Month Update

Headlines and Highlights

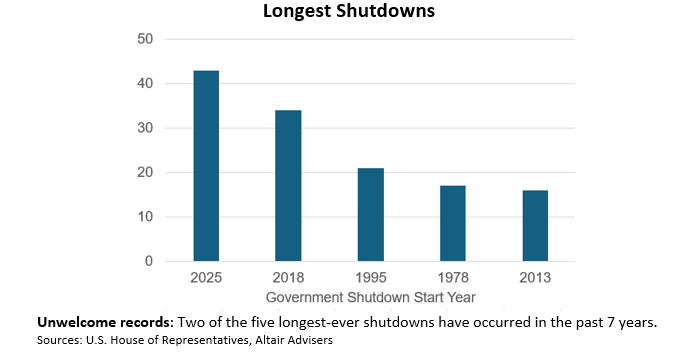

- Shutdown sets record: The federal government shutdown that began on October 1st finally ended last Wednesday after 43 days, surpassing the 2018 shutdown as the longest in U.S. history. The closure idled thousands of federal workers without pay and disrupted services across the country. The legislation approved by Congress and signed by President Trump funds the government through January 30th and pays for key agencies to keep operating through September 30th, the end of the fiscal year.

- Data delay raises questions about economy: The absence of reports about the U.S. economy’s recent performance due to the government shutdown has added to uncertainty about the labor market, inflation and the Federal Reserve’s next move on interest rates. Economic growth is still estimated to be strong. But non-governmental reports about a surge in private-sector layoffs in October and other data have created new concerns. Fed officials reportedly are split on whether to lower rates based on the most recent data; our view is that inflation will remain anchored and that the Fed will continue its rate-cutting cycle.

- Markets stumble in November: Most markets have lost ground this month amid anxiety about the sustainability of the AI-fueled rally and doubts about the probability of a December rate cut. The S&P 500 dipped 1.5% in the first half of the month, putting its six-month winning streak in jeopardy, but was still up 15.7% for 2025. Small caps were the biggest loser, sinking 3.6% (+8.2% for the year). International stocks resumed their outperformance over the U.S. with a fractional gain to push their year-to-date return to 28.1%. U.S. REITs were flat and bonds declined slightly.

Chart of Interest

Key Takeaways

- The U.S. Supreme Court in early November heard arguments regarding President Trump’s use of executive orders to impose sweeping tariffs on imports. A group of small businesses brought the lawsuit, saying the president is improperly using a “national emergency” law to justify the tariffs. Even if the justices rule against the president, the tariffs may not go away – the White House could rely on other existing laws to maintain them.

- Earnings for S&P 500 companies in the third quarter are up 13.1% compared to the same period in 2024, according to FactSet, with the reporting season nearly done. This marks the fourth straight quarter of double-digit profit growth for the index. The tech sector leads the way with 27.3% earnings growth, followed by utilities, financials and basic materials, all over 20% above their results of a year earlier.

- Corporate executives generally have a positive outlook regarding the U.S. economy, according to a Bloomberg analysis of earnings-call transcripts for the latest quarter. The finding is based on “economic downturn” or similar terms being mentioned during the calls. Negative references about the economy were down by almost half compared to the previous quarter.

- Consumer sentiment as measured by the University of Michigan fell to nearly a three-year low this month as Americans contended with persistent price inflation and the government shutdown. The latest sentiment number is just above the record low set in June 2022, the same month inflation peaked at over 9%.

- The penny has finally priced itself out of production, with the last one-cent coin rolling off the U.S. Mint’s production line in Philadelphia on November 12th. President Trump consigned the penny to the scrap heap, saving the government an estimated $50 million-plus per year, because each one cost about four cents to make. Roughly 300 billion existing pennies will remain in circulation.

The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Information herein incorporates Altair Advisers’ opinions as of the date of this publication, is subject to change without notice, and should not be considered as a solicitation to buy or sell any security. While efforts are made to ensure information contained herein is accurate, Altair Advisers cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. See Altair Advisers’ Form ADV Part 2A and Form CRS at https://altairadvisers.com/disclosures/ for additional information about Altair Advisers’ business practices and conflicts identified. All registered investment advisers are subject to the same fiduciary duty as Altair Advisers.